Rapid innovation, lean six sigma processes, flexible working conditions for employees, and the end of expensive IT infrastructure in-house: cloud computing can be a real cost-saver in a fintech company. In this article, we will review the advantages of AWS for Fintech.

Requirements for Implementing the Cloud in Fintech systems

Many fintech companies have adopted the cloud, and SaaS solutions are being used mainly in peripheral, non-core solution areas, like collaboration, customer relationship management, and the human resources department.

Several capabilities can be identified as related to the infrastructure and tools that can contribute to the Cloud adoption process from an infrastructure standpoint. Cloud Computing will proceed as long as the business strategy and business model are in place. As part of the Cloud Computing model, the key drivers are agility, lower barriers of entry, cost-efficacy, and efficiency. Business innovation, estimated costs, coordinating principles, and desired benefits are the other deciding factors.

AWS for Fintech:

Since Fintech startups are not dependent on legacy systems, they can take advantage of the cloud, the blockchain, and other revolutionary technologies. The low capital expenditure prices associated with Amazon Web Services Cloud are hugely beneficial for companies in the Fintech sector.

AWS Benefits for Fintech:

- One-click regulatory compliance

- The backup of all transaction data is seamless and secure

- Scalability and performance guarantee

- Full-time availability

- Promotes the DevOps culture

The AWS Fintech Architecture

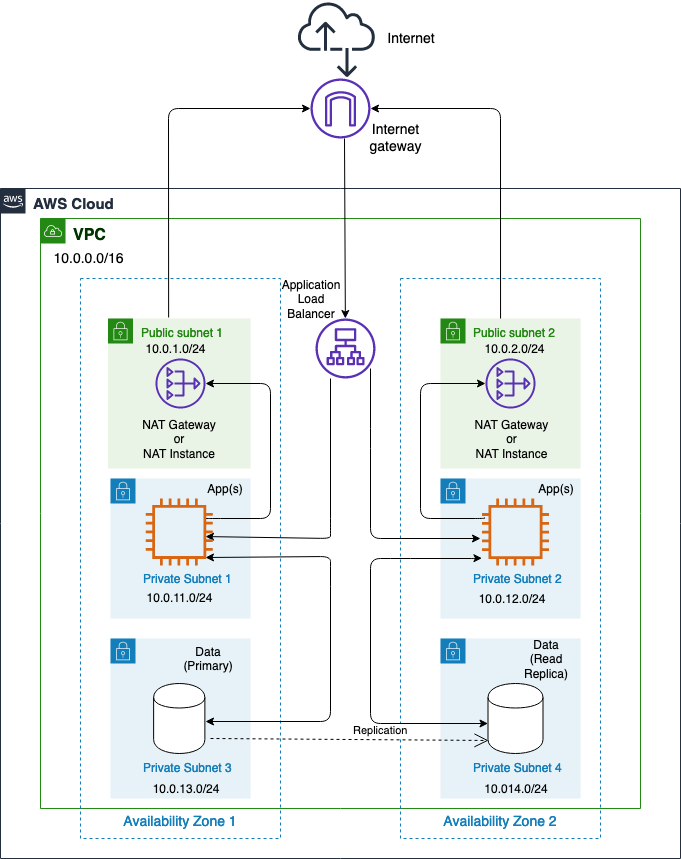

AWS makes it possible to establish a configuration server, map each server, and set up pricing. Applications are secured using a private virtual server. Redundancy is provided by resource storage in multiple availability zones. AWS EC2 instances are used to host web servers.

The architecture uses Elastic Load Balancer to balance traffic on your servers. The architecture minimizes latency with CloudFront distribution. It maintains edge locations by acting as a cache for traffic and streaming and web traffic.

Key Components of AWS Architecture for Fintech

Amazon S3

Banks usually have a web of siloed systems, making data consolidation difficult. But auditors expect detailed data presented understandably under Basel IV standards.

Creating a data pipeline will allow us to overcome this first challenge. Fintechs must inventory each data source as it is added to the pipeline. They should determine the key data sources, both internal and external, from which the initial landing page will be populated.

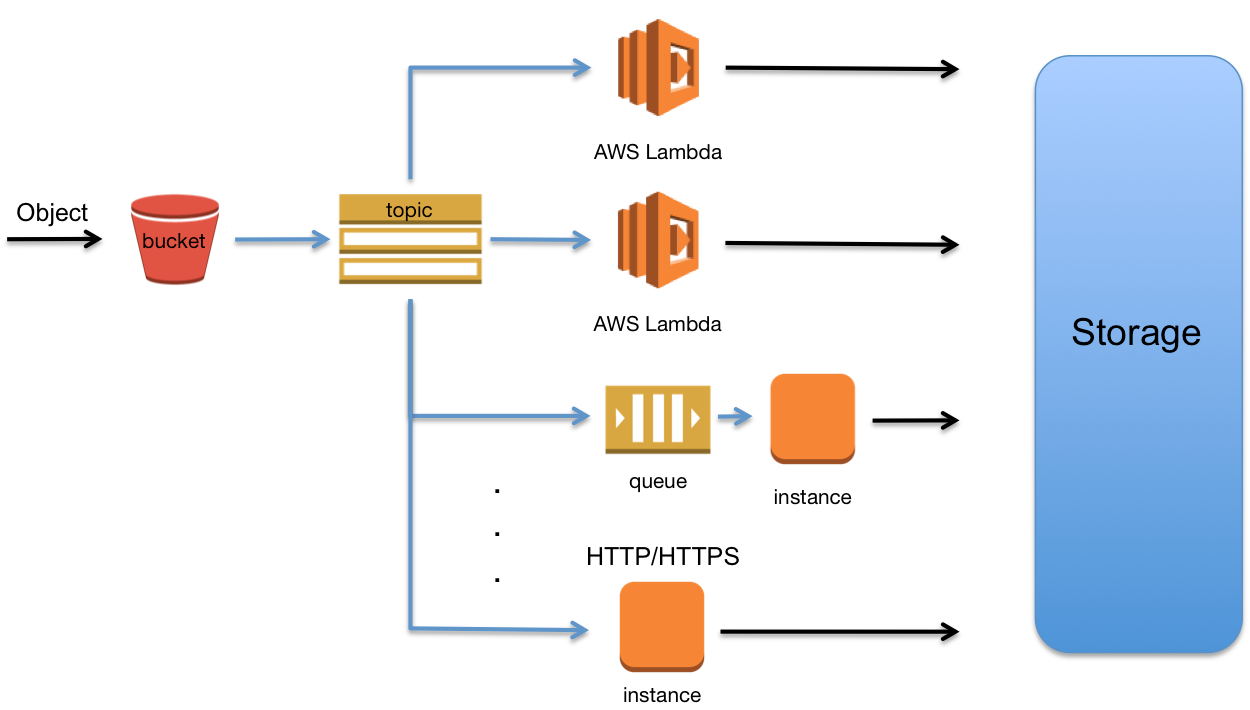

Amazon S3 provides a highly reliable, durable service. S3 offers capabilities like S3 Object Lock and S3 Glacier Vault for WORM storage. Using Amazon S3, you can organize your applications so that each event triggers a function that populates DynamoDB. Developers can implement these functions using AWS Lambda, which can be used with languages like Python.

CI/CD pipeline

CI/CD helps development teams remain more productive. Rework and wait times are eliminated with CI/CD in FinTech. By automating routine processes, software developers can focus on more important code quality and security issues.

But to implement CI/CD, Your workflow will have to change, your testing process will have to be automated, and you will have to convert your repository to Git. Fortunately, this can be all handled on AWS—with ease.

CloudSageMaker pipelines automate and deploy software for teams. The AWS SageMaker service provides machine learning capabilities. Engineers and data scientists can use it to create in-depth models.

Using AWS CodeCommit, teams can create a git-based repository to store, train, and evaluate models. AWS CloudFormation can be used to deploy code and configuration files stored in the repository. The endpoint can be created and updated using AWS CodeBuild and AWS CodePipeline based on approved and reviewed changes.

Every time a new model version is added to the Model Registry, AWS CodeCommit automatically deploys any update it finds in the repository. Amazon S3 allows models, historical data, and model artifacts to be stored.

AWS Fargate

Under the soon-to-be-enforced Basel IV reforms, banks’ capital ratios are supposed to be more comparable and transparent. They also call for more credibility in calculating risk-weighted assets (RWAs).

AWS Fargate empowers auditors to rerun Basel credit risk models under specified conditions using a lightweight application. AWS Fargate automates container orchestration and instance management, so you don’t have to manage it yourself. Based on demand, tasks will get scaled up or down automatically, optimizing availability and cost-efficiency.

The scalability of Fargate reduces the need for choosing instances and scaling cluster capacities. Fargate separates and isolates each task or pod by running each within its kernel. Thus, fintechs can isolate workloads to evaluate different risk models.

FinTech and AWS: A perfect match

AWS is a great fit for Fintech companies with an eye on ultimate digital transformations, thanks to its impeccable capabilities and full life cycle support.

At Cloudride, we simplify day-to-day cloud operations and migrations while also offering assistance with AWS cloud security and cost optimization and performance monitoring for Fintech companies.